Introduction

Over the past two decades, the world has seen a huge transformation in the global economic landscape. With governments across the globe making pro-business policies, large financial institutions supporting the growth, and lenders becoming more aggressive, entrepreneurship has boomed.

The money availability is high, and entry barriers are lowering in many countries. The technological advances and availability of the internet have further brought down the entry barriers. This, doubled up with the high-risk appetite of people, the rush to tap on available funds, and the shift from being an employee to being an employer, has created a whole new bunch of entrepreneurs.

India alone has over 61,400 startups recognized by DPIIT (Department for Promotion of Industry and Internal Trade). The economic survey of 2021-2022 highlights that atleast 14,000 startups out of the total were recognized in fiscal 2022.

Funding is an integral part of this entrepreneurial ecosystem. In many ways, it directly links to the economy.

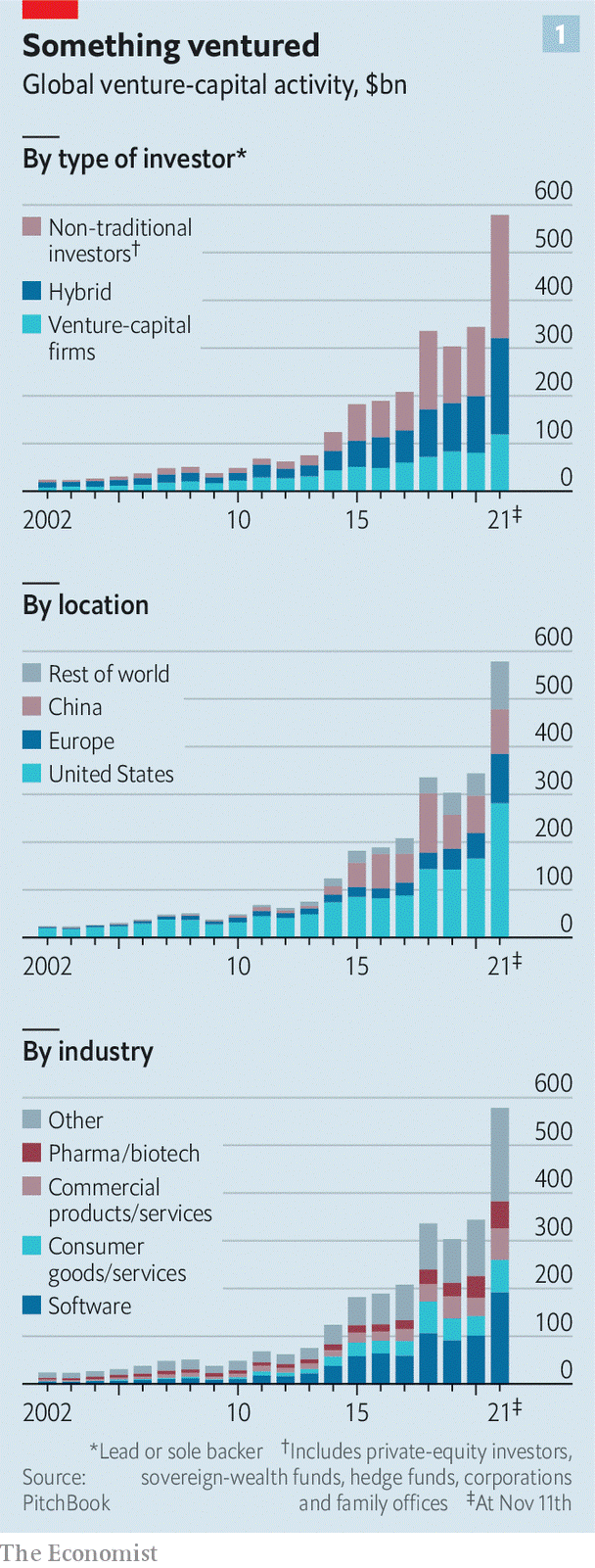

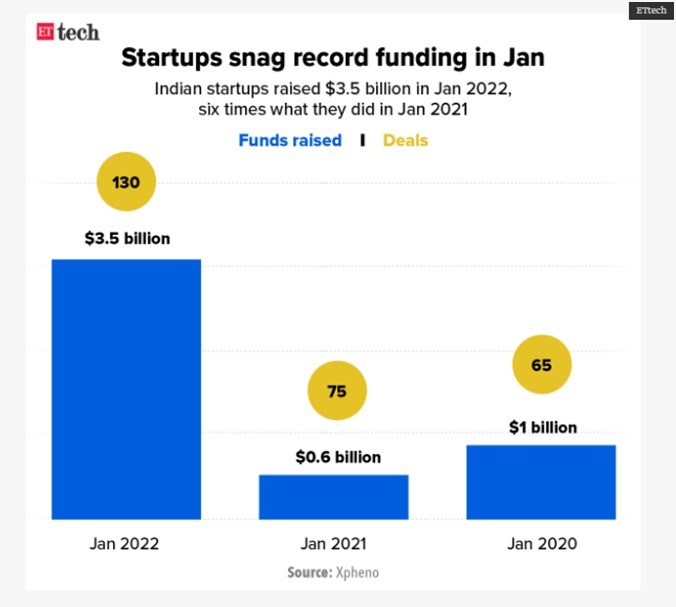

While the trend of establishing new businesses and funding them has seen an overall rise, the funding environment is not as straightforward as it seems. Many developed nations have seen the steady growth rate of VC funding going down. At the same time, many developing countries like India saw a meteoric rise in VC funding in 2021 alone.

Having said that, the funding environment is dependent on many factors. Everything, from government policies to public markets, from central reserves to geopolitical issues, impacts the funding, give and take. The competitiveness in the funding space and external factors influencing it, make it a difficult ground to play for the novices.

What makes the funding environment tough?

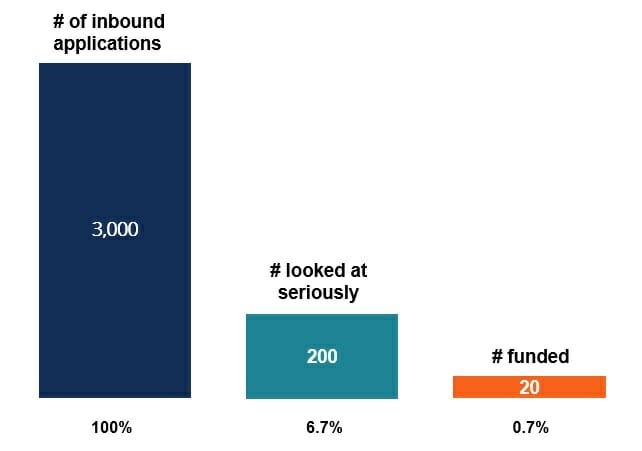

Funding is a complicated process, both for investors as well as seekers. Statistics show that, on average, only 1% of fund seekers get the desired investments. One of the top VC Firms, Andreessen Horowitz, states that they invest in only approx. 0.7% of all startups that approach them every year.

But the story doesn’t end here.

If 0.7% of companies get funded, only 8% of them succeed. This brings the total success rate of this whole cycle to 0.05%.

Thus, it is no surprise that investors want to be sure where they put their money. Also, the impact of the market impacts the funding environment. In a down-sliding economic ecosystem, the funding environment becomes tougher. It increases the challenges of the investment seekers significantly.

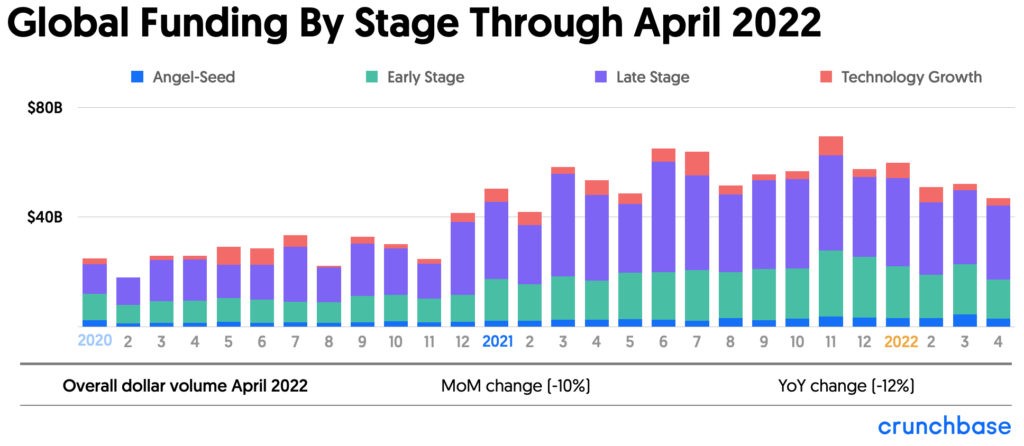

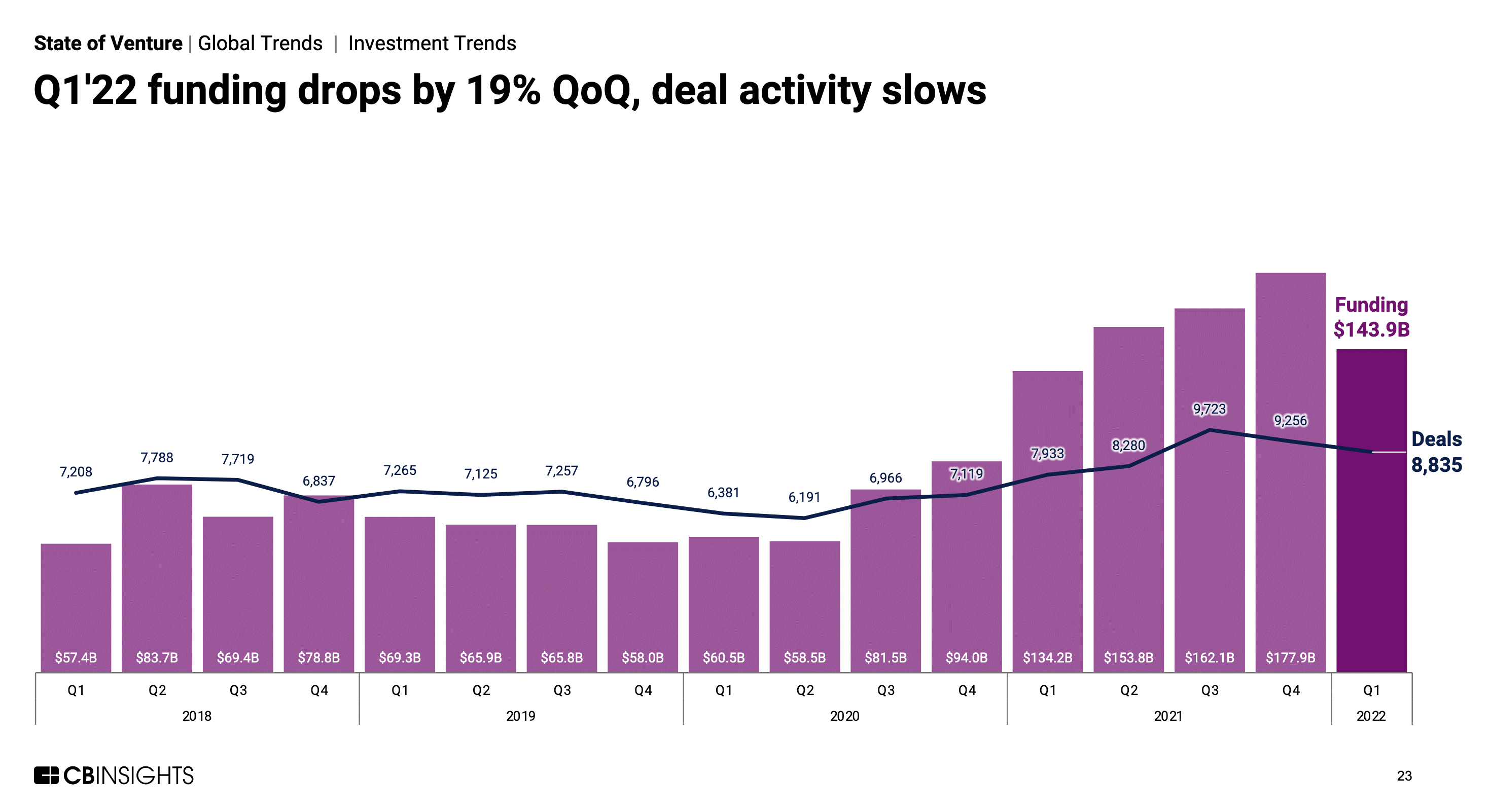

Statistics show that the global funding, which was low in 2020, rose well in 2021 but started declining in 2022. Correction in the markets, the anticipation of a recession, global inflation, and geopolitical crisis are all contributors to this decline.

It has thus imperative for investment seekers to know what exactly works. They need to be equipped with techniques to navigate the tough funding environment.

There is no better way to learn the art than by hearing it from the best minds in this space. Let’s look at what experts say about how to cut in the competitive funding environment.

Top ways to handle a tough funding environment

The data for 2022 so far shows a venture pullback across all funding stages. While the late-stage funding has seen the largest decline, the early and seed-stage funding has also been affected adversely. As of now, the seed and early-stage investments have held the ground, but the challenging environment is only getting tougher. Thus, fund seekers must focus on the following basics irrespective of their stages.

1. Do not lose focus on the fundamental cost-effectiveness of your business

David Klein, a contributor at Forbes, mentioned in his article that focusing on fundamentals helps startups raise capital under challenging environments.

Investors are keen to see the cost-effective scaling of your business. They want to see how disciplined you will be with their money. For later stages of funding, providing them with metrics like Lifetime Value to Customer Acquisition Cost shows how well you have run your business in the past. It builds the much-needed trust in your investors.

2. Shift your pitch from ‘Return’ to ‘Return +’

Gone are the days when investors only looked at returns. Today, they want to see a bigger picture. Investors focus on companies that offer a social good beyond monetary returns. “Having a purpose is more than a strong business advantage; it is a must,” says Alexander Skalabanov, co-founder and CEO of IntellectSoft (source). It is essential to refine and appropriately communicate your purpose to your investors.

3. Keep exploring government lending options

Entrepreneur.com published an article that recommends researching and making use of government loans. It is more advisable for small and medium enterprises that struggle with liquid reserves. However, it is also recommended to be cautious of large institutions and explore all options before taking the leap.

4. Be Well Prepared

For ages, we have known that the better the preparations, the better the chances of winning the war. Getting funding amidst tough competition is no less than a war. Thus, timely preparations are crucial for success. An important starting point is a clear strategy and vision for your business for the coming year or two. Researching and evaluating your funding options well in advance helps you be crystal clear when you pitch yourself to the funding institutions.

5. Do not shy away from making difficult decisions

As a business owner, survival is your topmost priority. Investor Ari Klinger, in his blogpost, recommends prioritizing survival and maintaining control. He suggests making difficult decisions early in life. If it means letting people go, it must be done, of course, respectfully. He also recommends testing your plans repeatedly with key stakeholders or getting external inputs on what investors could expect from you.

Conclusion

With the funding environment becoming increasingly challenging, entrepreneurs must understand the strategies that can work in their favor. It is essential to handle this environment tactically and focus on survival. By clarifying your business purpose, showcasing its cost-effectiveness, and being prepared for all circumstances, entrepreneurs can improve their chances of getting the desired funds.

In the end, do remember that the environment may be tough, but the right approach will always lead you to the top.